Impact Investing

What we do

Experts in fund management

We serve as a bridge between investors and high impact low-carbon projects. By investing in us you would be helping plug the $2.5 trillion funding gap for SMEs in Southeast Asia and accelerate the race to net zero by 2050.

Debt financing

$50,000 - $500,000

No collateral

About Pioneer Facility

The Pioneer Facility, managed by Nexus for Development is a developing economy impact investment fund that provides short to medium term debt capital to private growth-stage enterprises. We have disbursed $3.5m to growth-stage enterprises.

Through our strategic impact investments, we aspire to catalyze positive change, foster innovation, and contribute to the overall well-being of the communities we serve. Our commitment to impact investing underscores our dedication to generating meaningful and lasting benefits for both society and the environment.

Uncollateralized

Up to $500,000

10-12% interest

Up to 3 years

Our Investors

Investment impacts across the region

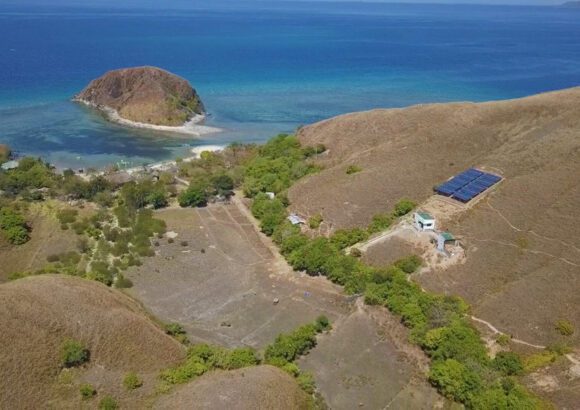

Solar energy in rural Philippines

Through the Pioneer Facility, OREEi were able to get two senior unsecured loans of $500k each to cover upfront costs for the implementation of a government project to bring solar energy to communities in the Philippines. The debt allowed OREEi to develop a track record of project delivery and unlocked further business and investment opportunities.

“The Pioneer Facility fund was exactly what we needed, when we needed it. They were able to deliver a specialized load package at a ticket size that usually has limited tenders. The loan allows us to engage in bigger projects and fuel our growth.”

Erel B. Narida, President and CEO, One Renewable Energy Enterprise, Inc.

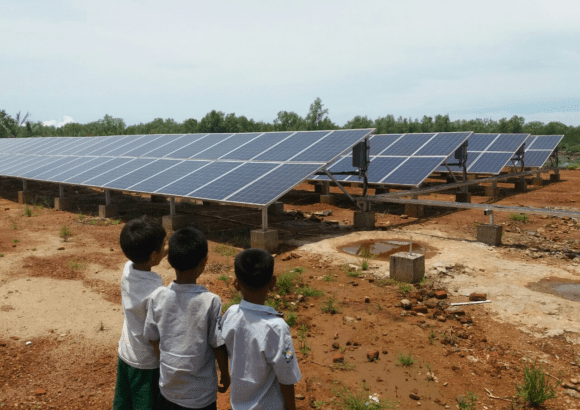

Solar microgrids expansion in Myanmar

Despite the challenges faced by the country and its population, Techno Hill has shown incredible resilience in Myanmar, and was able to implement 7 additional solar mini grids in the last two years. The company now operates a total of 20 in the country, supplying affordable energy to nearly fifty thousand people. The solar mini grids were developed under the National Electrification Plan (NEP), a program designed to accelerate energy access in a country that had an electrification rate of only 36% in 2016.

“By end of year 2022, an additional 3,000 people will be able to access electricity from the new mini grid at Thae Chaung village funded by the Pioneer Facility. We truly thank and appreciate Nexus for Development’s support and devotion to our remote community and their continuous trust in Techno-Hill in all circumstances. It is an honor for us to work with an investor whose vision and mission aligned with our business. With the impact financing from Pioneer Facility, Techno-Hill will commit and carry out the best for rural community developments.”

Mrs. Barani, Managing Director Techno Hill

Water stations in rural Cambodia

KWSH is working toward the consolidation of the fragmented piped water sector of Cambodia by acquiring, standardizing, and expanding small-scale piped water stations throughout the country. Nexus’s decision to invest is driven by KWSH’s track record in delivering piped water to rural Cambodia, where only 8.5% of households are connected to piped water. The company has already connected over 13,000 households to piped water and has a long-term plan to provide clean water to over 60,000 households and 300,000 individuals.

The Pioneer Facility collaborates with KWSH in an impactful investment initiative to directly fund the procurement of two new piped water stations, poised to connect approximately 12,500 households. This strategic venture, aligning with the principles of impact investing, not only facilitates the acquisition but also supports the development of water treatment facilities. The funds allocated will further contribute to essential aspects like hiring skilled staff, acquiring additional water sources, and deploying state-of-the-art equipment, including pipelines to households.

By 2026 – We aim to raise an additional $5.8 million for low-carbon climate solutions. Want to get Involved?

Case studies

Kiva is the world’s most popular crowdfunding platform. Through crowd-funding, early-stage enterprises are able to tap a broader network of smaller, individual lenders that they otherwise would not have been able to access.

As a valued field partner of Kiva, Nexus actively engages in impact investing by securing loans for social enterprises on Kiva’s platform. This pivotal role allows us to raise funds for deserving initiatives that might otherwise be ineligible for listing. Notably, our partnership empowers Nexus to raise loans up to USD 50,000, surpassing the typical limit of USD 10,000 for direct listings. This expanded capacity underscores our commitment to impactful financing for social enterprises through Kiva’s platform.

We provide access to finance for clean energy and water solutions across Asia

Carbon Finance

Whether you’re interested in purchasing voluntary carbon credits or seeking guidance on accessing the carbon markets, our experts are here to assist you.

Project Financing

Do you have a low-carbon, climate-positive solution in Asia? Partner with us to explore financing options that can help you scale.